Limited Company v Sole Trader?

Is being a sole trader or a limited company the most tax efficient form of business for me? This is a question that many people don’t consider as they see a limited company as having more paperwork, more accountant fees and more legal implications. The truth is however that the paperwork and the accountancy costs involved are often outweighed by the tax savings that you can get as a limited company.

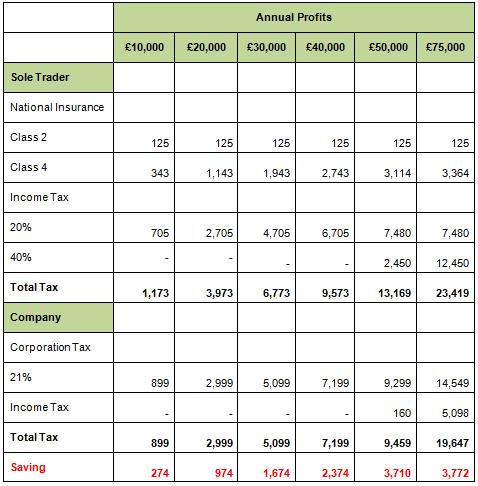

Below is an illustration that highlights the tax savings that a company could achieve based on the 2009/10 UK tax rates (these rates also apply for 2010/11 for income up to £150k). It is assumed that any company profits are first extracted by a salary of £5,720 in order to make the most of personal allowances and avoid national insurance contributions, with the remainder drawn as dividends. It is assumed in this example that there is no other taxable income to be considered.

If you believe that becoming a limited company may be of benefit to you and would like further advice on setting up a company and the legal implications and costs involved please contact me for further information dawn@abcnortheast.co.uk

Categories: Tax Saving