Emergency Budget – June 2010

Tuesday, June 22nd, 2010The full budget document can be viewed here through direct.gov

Full Emergency Budget Document

Key announcements included in the emergency budget were:

FAMILY

• Reductions in tax credit payments for families earning £40,000 or more, from 2011

• Child benefit will be frozen for the next 3 years but there will be no changes to who is eligible

• Council tax is frozen for one year from April 2011

• Health in pregnancy grant to be abolished from April 2011

• Child Tax Credit for low income families will increase by £150 per child above the rate of inflation next year

PERSONAL

• Annual allowance for income tax to increase by £1,000 to £7,475 from April 2011 although the higher rate threshold will be reduced so that higher rate taxpayers do not benefit from this change. This is worth £170 a year to basic rate taxpayers.

• Basic rate tax payers will continue to pay tax on capital gains at 18% but from midnight tonight, higher rate tax payers will pay tax on capital gains at 28%

• The annual exemption for CGT is to remain at £10,100

EMPLOYERS

• Increase in the threshold at which employers pay National Insurance by £21 per week

COMPANIES

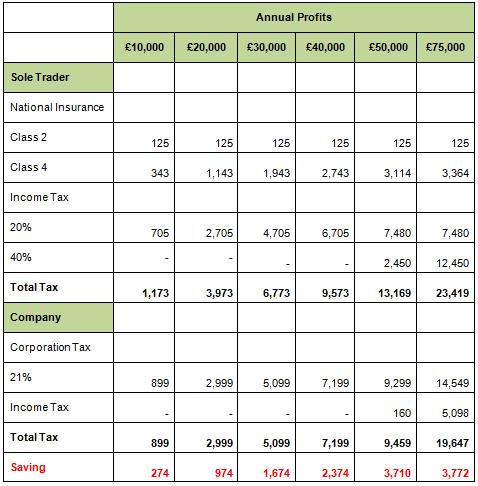

• Reduction in main corporation tax rate by 1% per year for 4 years, to 24% in 2014

• Reduction in small companies corporation tax rate to 20% from 2011

• Reduction in Capital Allowances from 2012. Plant and machinery allowances reduced to 18%, Allowances for longer term assets reduced to 8% and Annual Investment Allowance reduced to £25,000 per annum

• The standard rate of VAT to increase to 20% from 4th January 2011