The end of paper VAT returns

HMRC is reminding VAT-registered businesses that all VAT returns must be submitted online from this spring, meaning paper returns will soon be a thing of the past.

Currently, only newly-registered businesses and those with turnovers of more than £100,000 have to submit their VAT online, as well as pay electronically. Anyone else can send HM Revenue & Customs (HMRC) a paper VAT return, if they wish.

That is changing from April, when all 1.9 million VAT-registered businesses in the UK will have to submit their VAT returns online, and pay electronically, for accounting periods beginning on or after 1 April 2012.

Every VAT-registered trader not already required to submit online will receive a letter from HMRC in February, advising them of the change, and what steps they need to take.

To submit your VAT return online, you need to be registered and enrolled for HMRC’s VAT Online Service. To do this, visit www.online.hmrc.gov.uk and click “Register” under the “New user” section. Then follow the instructions.

Online filing has a number of benefits, compared to paper filing:

an automatic acknowledgement that your return has been received;

a handy sum checker; and

an email alert to remind you when your next online return is due (as, after April, HMRC will stop sending out paper returns to customers who are now required to submit online).

For details on the support available to help you move from paper to online VAT returns, visit www.hmrc.gov.uk/vat/online-return-help.pdf

Further help and advice is available from HMRC’s website at www.hmrc.gov.uk/vatonline. If that doesn’t answer your question, call the VAT Online Services Helpdesk on 0845 010 8500 (available between 8am and 6pm, Monday to Friday).

Source: (HM Revenue & Customs Press Office)

Class 2 NIC Changes

Changes to payment dates – Class 2 National Insurance contributions

From April 2011, payments for your Class 2 National Insurance contributions will become due on 31 January and 31 July, the same as a Self Assessment tax bill.

Payments made by internet/telephone banking, CHAPS, Bank Giro, Post Office or post

You will receive just two payment requests from HM Revenue & Customs (HMRC) in the year (instead of four bills) in October and April, showing payments due by 31 January and 31 July respectively. You do not need to wait until the due date to make payment.

Payment made by Direct Debit

To meet the new due by dates, collection of monthly Direct Debit payments will be delayed by HMRC to bring the payment dates into line. This means that:

• for the first year only, monthly Direct Debits will stop for a short period and then start again

• Class 2 contributions due for April 2011 will be requested from your bank in August 2011

• payments thereafter will be monthly unless you choose to pay 6 monthly from April 2011

A new option to pay by 6 monthly Direct Debit, collected in January and July each year, will be available from April 2011 for those who do not wish to spread their payments.

For those affected by these changes detailed information will be issued via a series of special mail shots in the coming weeks.

Change of our company name

You may notice that there has been a slight change to our invoices from this month onwards.

I have now changed the name of my company from Accountancy Brown Capper Limited to ABC North East Limited.

This will not affect your payments or invoicing in any way.

Thanks

Dawn

Increase in VAT Rates

The standard rate of VAT is currently 17.5 per cent but will be increased to 20 per cent on 4 January 2011.

For any sales of standard-rated goods or services that you make on or after 4 January 2011 you must charge VAT at the 20 per cent rate. If you have a cash business and calculate your VAT using the VAT fraction you must use the VAT fraction of 1/6 on your standard-rated VAT inclusive sales from 4 January 2011.

The change only applies to the standard VAT rate. There are no changes to sales that are zero-rated or reduced-rated for VAT. Similarly, there are no changes to the VAT exemptions. Any sales you make at these rates are unaffected by this change.

For those businesses on the Flat Rate VAT Scheme the new rates can be found on the following website.

Emergency Budget – June 2010

The full budget document can be viewed here through direct.gov

Full Emergency Budget Document

Key announcements included in the emergency budget were:

FAMILY

• Reductions in tax credit payments for families earning £40,000 or more, from 2011

• Child benefit will be frozen for the next 3 years but there will be no changes to who is eligible

• Council tax is frozen for one year from April 2011

• Health in pregnancy grant to be abolished from April 2011

• Child Tax Credit for low income families will increase by £150 per child above the rate of inflation next year

PERSONAL

• Annual allowance for income tax to increase by £1,000 to £7,475 from April 2011 although the higher rate threshold will be reduced so that higher rate taxpayers do not benefit from this change. This is worth £170 a year to basic rate taxpayers.

• Basic rate tax payers will continue to pay tax on capital gains at 18% but from midnight tonight, higher rate tax payers will pay tax on capital gains at 28%

• The annual exemption for CGT is to remain at £10,100

EMPLOYERS

• Increase in the threshold at which employers pay National Insurance by £21 per week

COMPANIES

• Reduction in main corporation tax rate by 1% per year for 4 years, to 24% in 2014

• Reduction in small companies corporation tax rate to 20% from 2011

• Reduction in Capital Allowances from 2012. Plant and machinery allowances reduced to 18%, Allowances for longer term assets reduced to 8% and Annual Investment Allowance reduced to £25,000 per annum

• The standard rate of VAT to increase to 20% from 4th January 2011

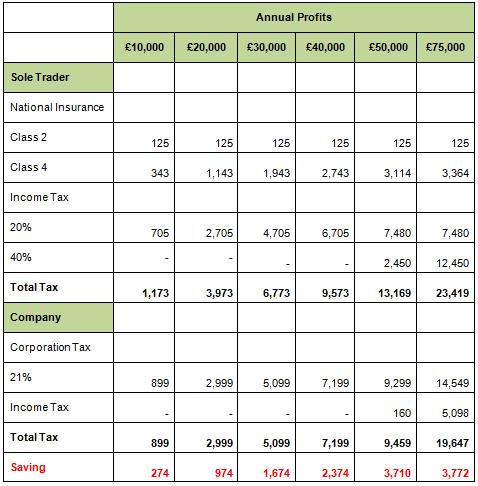

Limited Company v Sole Trader?

Is being a sole trader or a limited company the most tax efficient form of business for me? This is a question that many people don’t consider as they see a limited company as having more paperwork, more accountant fees and more legal implications. The truth is however that the paperwork and the accountancy costs involved are often outweighed by the tax savings that you can get as a limited company.

Below is an illustration that highlights the tax savings that a company could achieve based on the 2009/10 UK tax rates (these rates also apply for 2010/11 for income up to £150k). It is assumed that any company profits are first extracted by a salary of £5,720 in order to make the most of personal allowances and avoid national insurance contributions, with the remainder drawn as dividends. It is assumed in this example that there is no other taxable income to be considered.

If you believe that becoming a limited company may be of benefit to you and would like further advice on setting up a company and the legal implications and costs involved please contact me for further information dawn@abcnortheast.co.uk